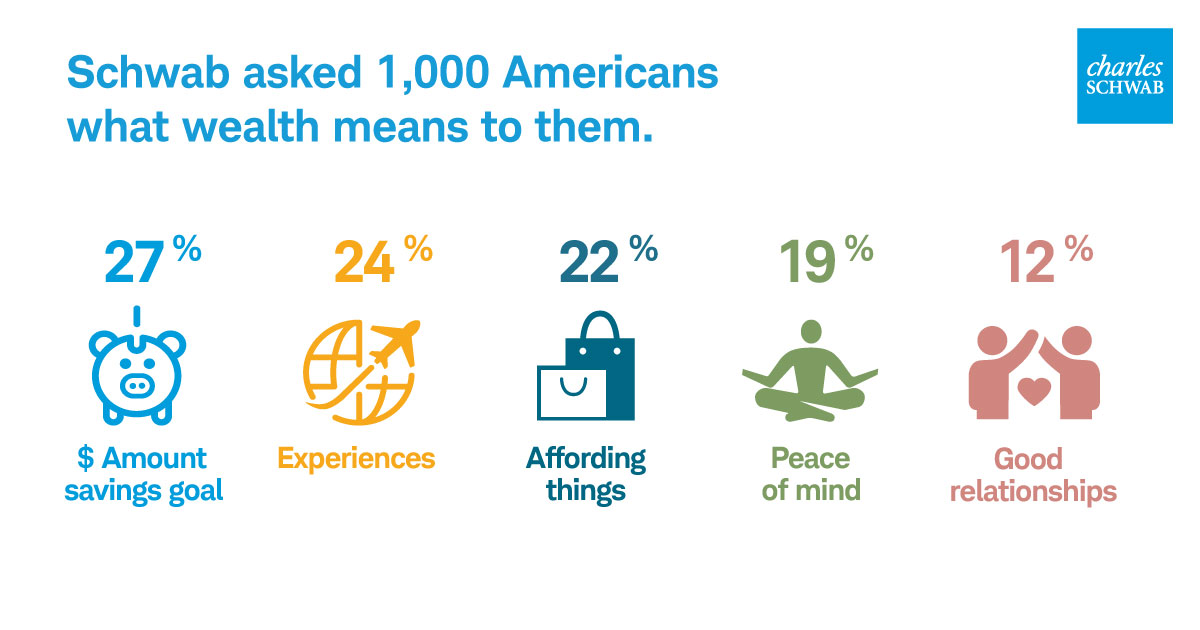

The article by CNBC explains how much your net worth needs to be to be financially comfortable and how much you will need to be wealthy. The source of this information is from Charles Schwab report “more than 50 times greater than the actual median net worth of U.S. households”. The report is interesting because it goes into details for the major cities that Americans live. The report also has a poll of 1,000 Americans were asked what does wealth mean to them. 27% say wealth means the amount of money in your saving account, 24% say experiences, 22% affording consumer goods, 19% say peace of mind and 12% say good relationships. Wealth means different things to everyone. At Loan Away, the majority of us concluded that peace of mind also known as financial independence is what wealth means. Knowing that you have enough money to live comfortably for years to come is true wealth.

Here’s how much money Americans think you need to be wealthy in 10 major US cities

When it comes to defining wealth, there’s no clear cut answer.

In fact, according to a 2017 survey from Charles Schwab, Americans are split on what rich means: Some describe wealth as a specific dollar amount and others as a state of mind.

Survey participants were also asked how much money is required to be considered “financially comfortable” and “wealthy” in their cities.

In the notoriously expensive San Francisco Bay Area, locals say you have to have a net worth of over $1 million just to be financially comfortable. To be rich, you need $4.2 million, which is “more than 50 times greater than the actual median net worth of U.S. households,” Charles Schwab reports.

Read on to see what residents of other major U.S. cities think it takes to be financially comfortable there and how much it takes to be wealthy.

Charlotte, North Carolina

To be financially comfortable, you need a net worth of $540,000

To be wealthy, you need a net worth of $1.8 million

Denver, Colorado

To be financially comfortable, you need a net worth of $540,000

To be wealthy, you need a net worth of $2 million

Chicago, Illinois

To be financially comfortable, you need a net worth of $560,000

To be wealthy, you need a net worth of $2 million

Boston, Massachusetts

To be financially comfortable, you need a net worth of $660,000

To be wealthy, you need a net worth of $2.1 million

Dallas, Texas

To be financially comfortable, you need a net worth of $670,000

To be wealthy, you need a net worth of $2.1 million

Seattle, Washington

To be financially comfortable, you need a net worth of $570,000

To be wealthy, you need a net worth of $2.4 million

Los Angeles, California

To be financially comfortable, you need a net worth of $830,000

To be wealthy, you need a net worth of $2.6 million

Washington, D.C.

To be financially comfortable, you need a net worth of $780,000

To be wealthy, you need a net worth of $3 million

New York, New York

To be financially comfortable, you need a net worth of $1.1 million

To be wealthy, you need a net worth of $3.2 million

San Francisco, California

To be financially comfortable, you need a net worth of $1.1 million

To be wealthy, you need a net worth of $4.2 million

thumbnail courtesy of cnbc.com

How does this make you feel? As a Canadian in Toronto, Canada, this is not surprising, to say the least. The housing market in large cities is expensive. A prime example is Vancouver, Canada. The housing prices over there are comparable to San Franciso, New York, and other large Amercian cities. What does this mean? Well, you will have to earn more money than the average person to even consider living in one of these cities. Furthermore, expect to be paying more money for a longer period of time each year you wait to buy. The housing market will only become more expensive as time goes on, so we recommend that you do two things before buying a home. 1. Wait for the bubble to pop. It will happen in the 2018 or 2019. Once it pops, the housing market will slow down. 2. Save every dime from now or increase your income. I know this is difficult, but if you don’t do one of the two, you will might not even be able to afford anything in any big city. We hope you enjoyed this article. If you did, please let us know on Twitter, Facebook, Instagram.